I have been thinking a lot about what would make a good topic to write, after featuring ICOs and blockchain in this site. The original idea was to move on to another genre away from blockchain technology, such as machine learning/artificial intelligence. But I felt there is a need to address about smart contracts to provide a fitting closure to the blockchain genre, since smart contracts are mentioned in the two articles and yet did not have enough screen time for elaboration.

Smart contracts – it is quite tempting to perceive at first glance that this could be something revolutionary. After all, anything that adds the word “smart” in front would suggest a radical shift from its original nature. Just take smartphones for instance – Alexander Graham Bell would not in his wildest dreams foresee his invention of communicating through electric wires would have come to this day of wireless and interactive communications (which also means having to bear with dog-faced Snapchat filters). But I digress – does putting the word “smart” before contracts presents a tectonic shift to the legal contracts as we know it?

My readings will be from Blockgeeks Inc., Coin Center, Bloomberg (an opinion piece by Elaine Ou, a blockchain engineer, and a news article) and MIT Technology Review (both articles by Mike Orcutt). The references will be included below.

What is the subject about?

The phrase “smart contracts” was coined by Nick Szabo (a legal scholar and cryptographer) in 1994 after realising that the blockchain could be used for digital contracts. And according to Blockgeeks, smart contracts are contracts converted into code, stored and replicated in the system and supervised by the network of computers running the blockchain, resulting in ledger feedback, such as transfer of money, or the receiving of product or service.

The article also quoted Nick Szabo’s analogy of the vending machine, where the machine takes a coin and dispense a product and the correct change according to the displayed price – the parallel being the blockchain (digital ledger) takes the coin (or a certain asset) and runs the code until it reaches a point that it validates a condition and determines how the asset should be managed, such as transferring to another person, or to be refunded back to the person, or any combination of both.

Mike Orcutt from MIT Technology Review further elaborates Nick Szabo’s view, in that the vision is to embed the many contractual clauses in the hardware and software we use and interact with such that the breach of contract would be expensive. However, the author pointed out in a separate article that the newness of the technology meant that there was no agreed definition on what smart contracts are (and this has implied consequences, which will be elaborated later).

How does it work?

Continuing in MIke Orcutt’s article in MIT Technology Review was a distilled technical definition of smart contract: it’s simply an “If-Then” statement that runs on a blockchain.

Blockgeeks illustrated how a smart contract may work in an example of an apartment rental through the blockchain (and payment is made by cryptocurrency): a receipt of the rental is held in a virtual contract; a digital entry key comes to the tenant by a specified date or otherwise a refund is released,; the system works on the If-Then premise witnessed by people on the blockchain ensuring a faultless delivery; the document is cancelled automatically after the agreement period expires; the code cannot be interfered by either landlord or tenant without the other knowing since all parties are simultaneously alerted should there be changes.

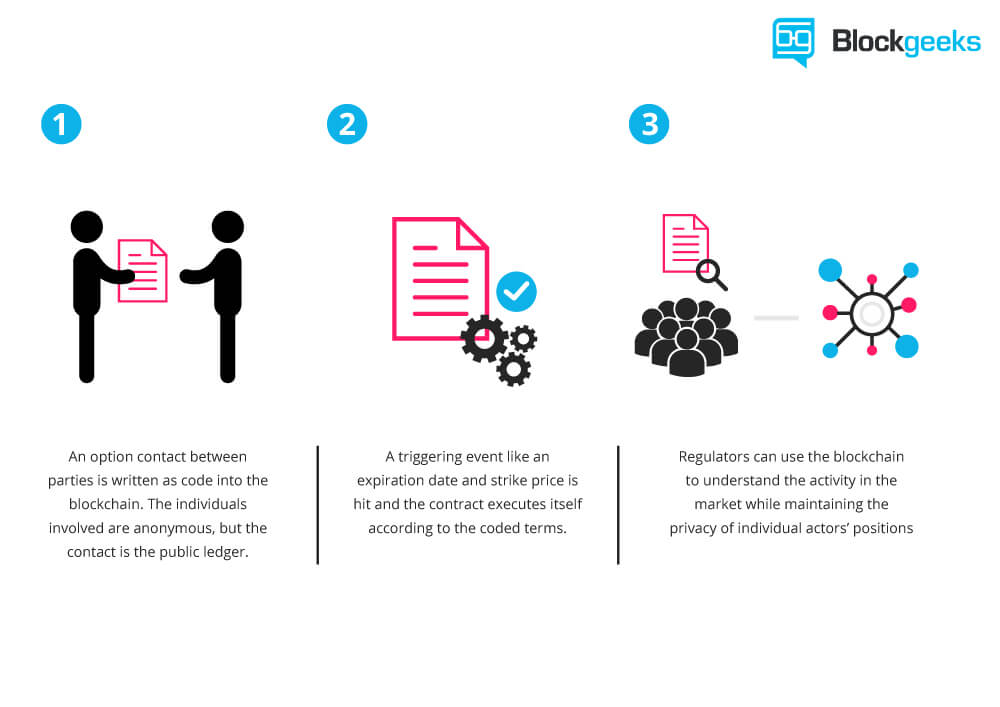

The same site also provided example in a basic code on Ethereum, as well as a visual illustration:

How does it impact (in a good way)?

As you can see from the visual illustration, there would be opportunities of automation at the registry and even at a legal institution (or at least what a courthouse looks like). Coin Center’s Houman Shadab pointed out that smart contracts may reduce the need for litigators, judges and arbitrators since the execution of a contract is done automatically without human element, and is verified by witnesses i.e. the network of people in the blockchain.

The other reduction we see would be the need for intermediaries. We may need to rely on brokers and lawyers to prepare (monitor and execute) an agreement currently, while smart contracts may enable us to create (and manage) these agreements on our own in the future, thereby eliminating the need for middlemen. That being said, as Houman Shadab pointed out, the use of smart contracts would lead to an increase in the need for transactional attorneys and others to structure smart contractual relationship. Blockgeeks offered a different possibility of the future, where lawyers would change from writing traditional agreements to coding standard smart contract templates (such as those traditional contract templates on LegalZoom).

Blockgeeks outlined the benefits of smart contracts, which sounded similar to the blockchain: Autonomy (no need for intermediaries, reducing third-party manipulation), Trust and Safety (encryption on a shared ledger), Backup (documents are duplicated many times over the blockchain network), Speed (automation of task processes), Savings (elimination of intermediaries or notaries for a transaction), Accuracy (errors in manual input of forms avoided through automation).

There are currently several real-world use cases of smart contracts. The Depository Trust & Clearing Corp (which was mentioned in the previous post on blockchain) in 2015 has processed 345 million securities transactions on a blockchain ledger, while Barclays Corporate Bank have partnered with a blockchain tech company, Wave in testing the use of smart contracts to log change of ownership and automatically transfers payments to other financial institutions within supply chain management. Bloomberg also reported several cases of smart contracts being tested on the equity- and credit-default-swaps markets.

Of course, the potential of smart contracts can be scaled up to cover other areas of life, such as government (electronic voting), management (process automation), automobile (accident fault detection, variable-rate insurance), and healthcare (transferring of health records to insurance providers, healthcare management i.e. supervision of drug administration, test results etc.).

What are the issues?

At present, there are trust issues with the blockchain platforms on which smart contract attempts are built upon. According to Elain Ou’s article, in 2017, $150 million worth of ether were stuck in multi-signature wallets (which functions like joint bank accounts requiring permission of two or more individuals) after a botched hacking attempt. Earlier in the same year, a Canadian exchange, QuadrigaCX accidentally trapped $13 million in its own broken smart contract. And yet according to the author, the multi-signature wallet is the simplest application one can build based on smart contracts.

These issues came about due to the wallets’ reliance on a single, centralised bit of code which made it vulnerable to hacking attacks and trapping users’ funds within the wallet. And to make matters more difficult, the immutability nature of smart contracts (and the blockchain) makes issues harder to resolve or contracts to be rescinded.

Smart contracts’ vague definition (earlier mentioned) also caused different understanding among legislators, which potentially causes chaos from the variation of smart contracts’ governance. Mike Orcutt reported the cases of legislators in Tennessee and Arizona legally recognising smart contracts to attract investments and entrepreneurs, but also highlighted the difference in the laws enacted by the respective states. Furthermore, the Chamber of Digital Commerce argues that existing laws have provided an “unquestionable legal basis” for smart contracts, which are essentially legal contracts executed on the blockchain – hence Orcutt’s point that “a smart contract is simply an “if-then” statement that runs on a blockchain”.

On a practical level, the problems of smart contracts pile up. Blockgeeks highlighted the potential issues of bugs in smart contracts’ code, government regulation, taxation, legal jurisdiction and enforcement on non-digital components in a contract (for example, a rental agreement via a smart contract would be difficult, if not impossible, to enforce the clause of prohibiting the tenant to make the rented property for public use).

Houman Shadab highlighted several issues that are on a conceptual level. Since smart contracts are immutable, this would led to contracts ending up being ambiguous and imprecise, as contracting parties would prefer flexibility and avoiding to lock themselves into rigid commitments and outcomes. The example given in the article was the renegotiation feature of a traditional contract when circumstances change, like a contract for an actor can be renegotiated after his/her debut movie became a big hit.

Shadab further added that the real world is not sold on the benefits brought about by presently available systems that are similar to smart contracts, such as bank payment obligations – an electronic letter of credits that pays the seller if the correct data showing the goods were shipped to the buyer were transferred to the bank – which were slow to be adopted by corporate clients of banks due to the lack of awareness, critical mass and cost of implementation.

Not to mention, there are already automation in the contracting process and related business operations in which smart contracts are expected to replace. The promises of smart contracts may have been captured with the likes of automation softwares provided by software companies such as Oracle (PeopleSoft platform), ABLSoft and Ftrans.

The allure of smart contracts, after all, may not be that attractive as we perceive.

How do we respond?

In view of the many issues surrounding smart contracts, it goes without mention that there is much room for improvement for this piece of innovation. As a start, Shadab pointed out that built-in mechanisms and protocols would be needed to facilitate adjustments in the terms of an agreement without the need for renegotiation. This would mean that users would not need to require new code when there arise a need for changes in terms as circumstances change.

The author further urged for smart contracts to overcome problems of existing contract automation initiatives to provide differentiation points over them, making smart contracts as a viable replacement over them. This could be done by having features over and above those offered by companies selling contract-enhancing softwares.

Elaine Ou implied that blockchain platforms would need to prove itself to be trustworthy and reliable for smart contracts to operate, in order to restore trust within the public and facilitate mass adoption. Improvements, though, would be “an onerous, slow-moving process” unlike the surge in cryptocurrency prices in 2017.

We as a society would also need to better understand the implications of smart contracts, namely the empowerment of users to manage their own rights and obligations in the apparent absence of intermediaries or legal institutions. This would possibly require a paradigm shift, a generation’s mindset and lifestyle overhaul, assuming conventional contracts and agreements would be replaced with digital contracts with automatic enforcement

But for now, there are just quite a myriad of issues for smart contracts to address and overcome – so much so that the blockchain engineer called them outright “dumb”. Would the idea of smart contracts work eventually, though? Perhaps we have to take cue from the earlier example of Alexander Graham Bell’s invention of the phone, and keep an open mind to future’s endless possibilities.

References

What Are Smart Contracts? A Beginner’s Guide to Smart Contracts – Blockgeeks: https://blockgeeks.com/guides/smart-contracts/

What are Smart Contracts, and What Can We do with Them? – Coin Center: https://coincenter.org/entry/what-are-smart-contracts-and-what-can-we-do-with-them

Smart Contracts Are Still Way Too Dumb – Bloomberg: https://www.bloomberg.com/view/articles/2017-11-16/smart-contracts-are-still-way-too-dumb

Blockchain Gets a Wall Street Win: ‘We Know the Thing Works Now’ – Bloomberg: https://www.bloomberg.com/news/articles/2017-11-20/blockchain-gets-a-wall-street-win-we-know-the-thing-works-now

Ethereum’s smart contracts are full of holes – MIT Technology Review: https://www.technologyreview.com/s/610392/ethereums-smart-contracts-are-full-of-holes/

States that are passing laws to govern “smart contracts” have no idea what they’re doing – MIT Technology Review: https://www.technologyreview.com/s/610718/states-that-are-passing-laws-to-govern-smart-contracts-have-no-idea-what-theyre-doing/

Featured Image from Blockgeeks: https://blockgeeks.com/guides/smart-contracts/